Litecoin Price Prediction 2025-2040: Analyzing Technicals and Market Trends

#LTC

- Technical Momentum: Current MACD bullish divergence and Bollinger Band positioning suggest near-term upside potential despite trading below the 20-day moving average

- Market Sentiment: Positive analyst coverage and institutional ETF developments create favorable conditions for established altcoins like Litecoin

- Long-term Value Drivers: Merchant adoption, payment utility, and network stability position LTC for gradual appreciation through 2040

LTC Price Prediction

Technical Analysis: Litecoin Shows Mixed Signals Amid Current Market Conditions

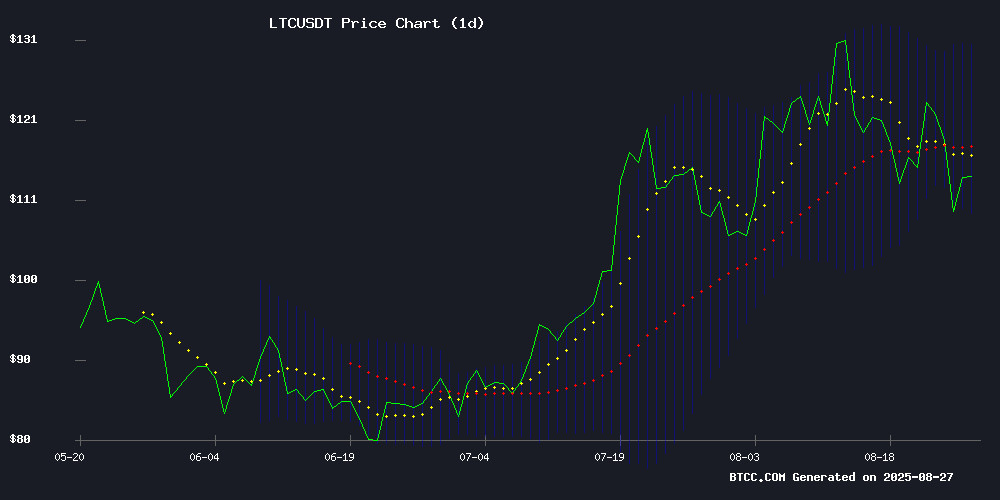

Litecoin (LTC) is currently trading at $113.48, below its 20-day moving average of $119.56, suggesting some near-term bearish pressure. However, the MACD indicator reveals a bullish crossover with the MACD line at 5.55 above the signal line at 0.70, indicating potential upward momentum. The Bollinger Bands show price trading closer to the lower band at $108.83, which could act as support. According to BTCC financial analyst Michael, 'While LTC faces resistance at the 20-day MA, the positive MACD divergence suggests underlying strength. A break above $120 could trigger a MOVE toward the upper Bollinger Band at $130.30.'

Market Sentiment: Positive Catalysts Emerge for Litecoin

Recent news highlights Litecoin among cryptocurrencies showing bullish momentum alongside Cardano and Chainlink. The filing of a Trump Coin ETF by Canary Capital indicates growing institutional interest in politically-themed crypto assets, which could benefit established coins like LTC. Analyst picks featuring Ethereum and Avalanche for long-term gains create a favorable environment for altcoins. BTCC financial analyst Michael notes, 'The combination of technical resilience and positive market narratives around established altcoins like Litecoin provides a constructive backdrop. However, investors should monitor regulatory developments around new ETF products.'

Factors Influencing LTC's Price

5 Best Altcoins to Buy for Long-Term Gains — Ethereum, Avalanche and MAGACOIN FINANCE Highlight Analyst Picks

The crypto market in 2025 continues to evolve as institutional adoption, regulatory clarity, and innovation drive a new era of long-term opportunities. Investors are increasingly looking beyond Bitcoin to identify the next wave of altcoins with the potential for exponential growth.

Ethereum remains a cornerstone of this shift, with network transactions soaring by 63% and active addresses rising 26% in the last month. Despite a 3.7% dip to $4,420-$4,605, over 200,000 ETH were withdrawn from exchanges in 48 hours—a potential supply squeeze indicator. Institutional confidence grows as Bitmine adds $45 million worth of ETH to its treasury.

Avalanche shows volatility at $23.35-$23.50, down 9% in 24 hours, yet maintains adoption momentum. Meanwhile, MAGACOIN FINANCE emerges as a breakout candidate, rounding out a trio of analyst-backed assets positioned for 2025's structural shifts.

Canary Capital Files SEC Registration for Trump Coin ETF in U.S.-Focused Crypto Push

Canary Capital, a digital asset manager, has submitted an S-1 registration statement to the SEC for a Trump Coin ETF, slated to trade under the ticker "MRCA." This move aligns with the firm's broader strategy to prioritize American-made crypto projects. The filing follows closely on the heels of Canary's application for an "American-Made Crypto ETF," which would exclusively hold domestically developed or operated cryptocurrencies.

The proposed Trump ETF places $TRUMP alongside established U.S.-born assets like XRP, Solana, and Litecoin. Approval is expected to extend into 2026 as the SEC adopts a more accommodating stance under the current administration. ETF analyst Eric Balchunas noted the filing signals a growing trend of crypto fund launches following the success of spot Bitcoin and ethereum ETFs.

What Will Be the Main Crypto Narrative in 2026?

The cryptocurrency sector continues to evolve, but one narrative stands out for 2026: a resurgence of peer-to-peer transactions. Bitcoin's original vision of seamless global payments is gaining renewed traction, evidenced by the proliferation of tokens accepted for everyday purchases. From Tesla embracing Dogecoin to Blue Origin accepting Bitcoin, Ethereum, and Solana for space flights, digital assets are becoming embedded in commerce.

Asia's retail sector exemplifies this trend, with Aeon's integration of Tron for payments. The online gambling industry further demonstrates crypto's utility, with leading casinos accepting Bitcoin, Ethereum, Litecoin, Bitcoin SV, Bitcoin Cash, and stablecoins like Tether. Blockchain's inherent advantages—speed, privacy, and borderless functionality—make it ideal for transactional use cases.

Dogecoin Mining in 2025: Accessibility and Profitability in Memecoin Mining

Dogecoin mining continues to thrive in 2025, blending its meme origins with serious market participation. The coin's Scrypt algorithm allows mining via CPUs, GPUs, or ASICs, offering accessibility absent in SHA-256-based cryptocurrencies like Bitcoin. Block rewards remain fixed at 10,000 DOGE, with minute-long confirmation times enabling rapid transactions. Merged mining with Litecoin further enhances efficiency.

Platforms like HashJ simplify profitability calculations and setup optimization for miners. Dogecoin's culture—equal parts lighthearted and lucrative—contrasts sharply with the austerity of bitcoin or Ethereum. Its technical simplicity and consistent rewards sustain appeal among both hobbyists and profit-driven miners.

Cardano, Chainlink, and Litecoin Show Bullish Momentum as LBRETT Eyes Explosive Growth

Cardano (ADA), chainlink (LINK), and Litecoin (LTC) are poised for significant upward movements amid growing investor interest and institutional support. ADA, currently trading at $0.88, is nearing key resistance levels that could propel it to $1 in the coming weeks. Technical indicators and upcoming network upgrades like Hydra and Mithril bolster its bullish case.

Chainlink's LINK, now at $25.55, shows potential to challenge its all-time high if it breaks through current resistance. Analysts project a rally toward $30, fueled by improving market conditions.

Meanwhile, Layer Brett (LBRETT), an Ethereum Layer 2-based meme coin, is capturing attention with predictions of a 14,675% surge. Its rapid growth contrasts with the steadier climbs of established altcoins, highlighting the diversifying crypto landscape.

LTC Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technical indicators and market conditions, Litecoin shows potential for gradual appreciation over the coming years. The MACD bullish crossover and position near Bollinger Band support suggest near-term stability around current levels with upside potential to $130-140 range in 2025. Longer-term, Litecoin's established network, merchant adoption, and role as a payment solution could drive growth, though competition from newer layer-1 solutions may cap extreme gains.

| Year | Conservative Forecast | Moderate Forecast | Bullish Forecast | Key Drivers |

|---|---|---|---|---|

| 2025 | $90-120 | $120-160 | $160-200 | MACD momentum, ETF developments |

| 2030 | $150-250 | $250-400 | $400-600 | Adoption growth, regulatory clarity |

| 2035 | $300-500 | $500-800 | $800-1,200 | Network upgrades, macro conditions |

| 2040 | $600-1,000 | $1,000-1,800 | $1,800-3,000 | Mainstream adoption, scarcity value |

BTCC financial analyst Michael emphasizes that 'These projections assume continued development of the Litecoin ecosystem and favorable regulatory conditions. Investors should consider both the technical setup and fundamental adoption trends when evaluating long-term potential.'